Challenges and Opportunities of Electric Vehicles

A brief analysis of the electric vehicle space and what it will take to reach mass adoption of EVs.

In 2019, Herbert Diess, CEO of Volkswagen, said that electric vehicles were "not yet ready for the mass market."

Volkswagen has since announced plans to invest $86 billion in electric vehicles by 2026.

This may sound like hypocrisy, but it's a natural progression for VW alongside the now ever-present climate change concerns. It's necessary for car manufacturers to invest substantially to respond to consumer demand and make their EV models mass-market-ready.

Summary

Electric cars are currently $12,000 more expensive than combustion cars.

You must charge an EV every 200-300 miles.

The scarcity of charging infrastructure all across the US is a major challenge for the government to overcome.

Being expensive, there are only 20,431 level 3 charging stations (the quickest EV charging stations). It’s six times less than the number of level 2 charging stations - 126,500.

20-50% more electricity will be drawn from the grid as more people switch to EVs.

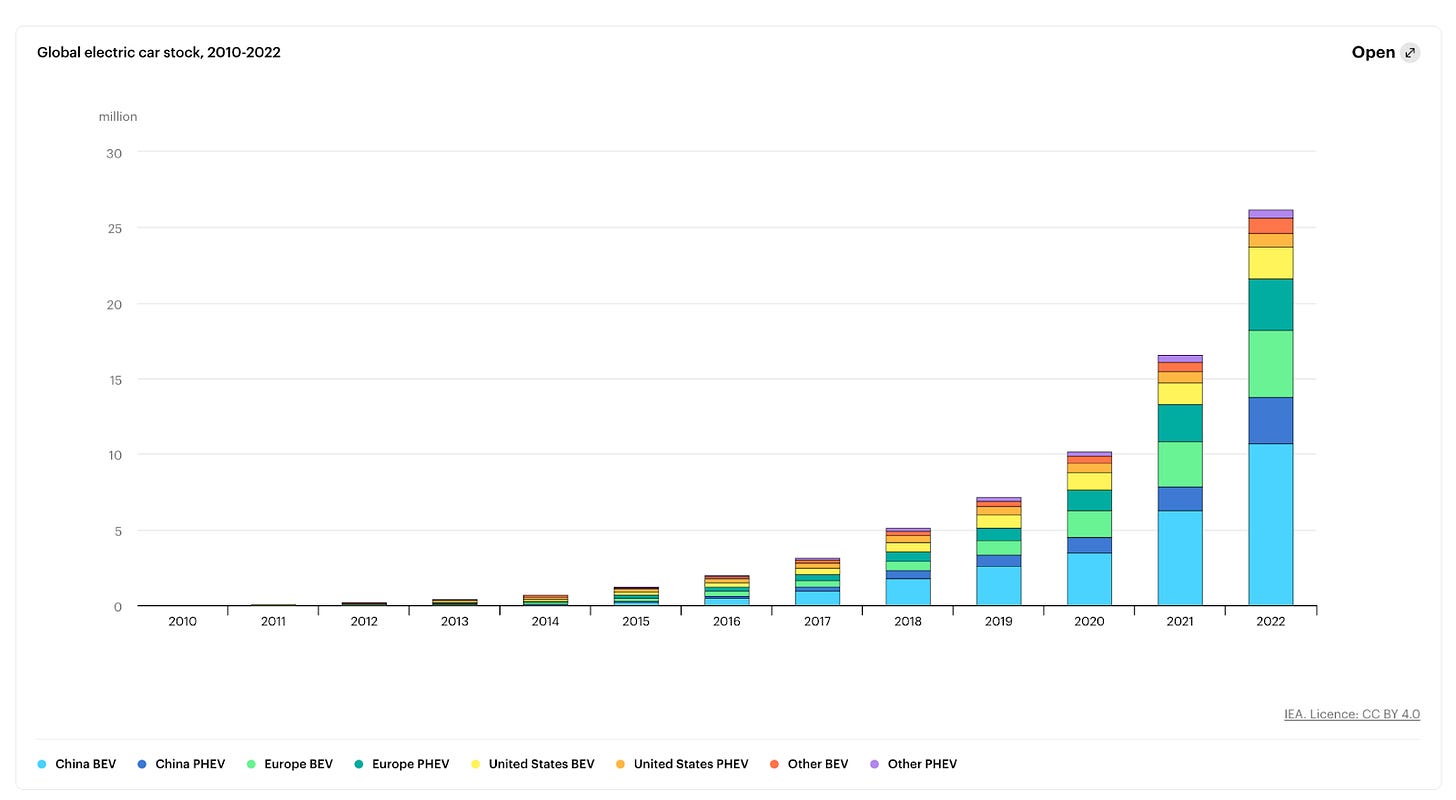

The demand for electric vehicles worldwide has already increased from 5 to 25 million.

The US government is implementing policies to reduce manufacturing costs and offer customer subsidies for EV purchases.

EVs are the Future of Transportation for Personal & Commercial Road Vehicles

Challenges

I'll be frank - most people don't want to buy EVs, and for good reasons. There's a higher upfront cost, not many options to choose from, the dreaded 'range anxiety,' and a lack of charging infrastructure. It's a large task to overcome these challenges and convert more gas-guzzling drivers to EV drivers, but the proper policies and infrastructure investments can pave the way for a cleaner, greener future on the road.

#1. High Purchase Cost

Electric vehicles are more expensive to build than gasoline-powered ones. The primary reason is that they require lithium for their large batteries, which is costly and drives the cost up.

Despite the higher upfront cost, electric vehicles promise lower operating costs over their lifetime. But there's a catch - you have to buy it first. With few models on the market sporting a sticker price of less than $30,000, the initial investment can be a significant hurdle for many potential EV buyers.

#2. Range Anxiety

It's a sunny Saturday morning, and you're setting off on a weekend getaway in your new electric car. The open road beckons, the playlist is set, and the sense of adventure is palpable. But lurking in the back of your mind is - range anxiety.

In ideal conditions, your EV promises a range of 200-300 miles on a single charge. It's more than enough for your daily commute, but it's a different story for longer journeys. Those long days on the road, spontaneous detours, and freezing weather all eat into your vehicle's range. And before you know it, you end up taking frequent charging breaks.

To charge an EV, there are charging stations built nationwide. There are three primary levels of EV chargers: Level 1, Level 2, and Level 3. Level 2 chargers provide a full charge in as few as 3-4 hours (or as much as 10-12 hours, depending on battery size). A DC fast-charging station can take 30-60 minutes to charge an EV battery to 80%, which sounds fast until you consider how much time that can add to longer journeys—something to consider when traveling cross country.

Range anxiety is more than a slight concern for potential EV owners - it's a significant hurdle to overcome and contributes to ~36% of drivers’ reasons for buying a gas car instead of an EV.

#3. Limited Selection

When we compare the car selection for EVs and gas-powered vehicles, EV models are significantly limited. As of March 3, 2023, there are 40 battery-electric vehicle models available in the US. This is nowhere near the number of models available for a gas-powered vehicle, that’s 7023. Although electric sedans, hatchbacks, and SUVs are becoming more readily available, people looking for a truck or minivan have only a few options.

#4. Difficulty Finding a Technician

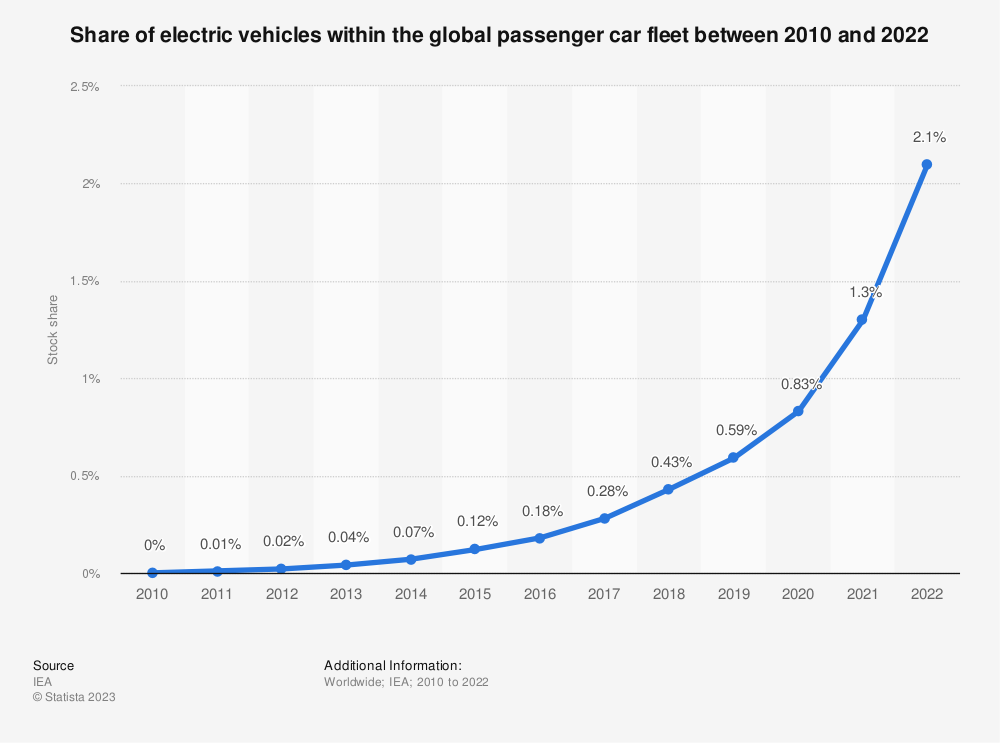

Unlike combustion vehicles, EVs are still relatively new to the market and make up just 2.1% of passenger cars on the road. With so few EVs on the road, finding a specialized mechanic will be challenging. You see, EV engines aren’t the same as combustion engines. The high-voltage systems in these vehicles can pose a danger to an untrained technician, turning a routine repair into a potential hazard.

The number of trained EV repair technicians and specialized shops is low. Working on an electric vehicle is not just about changing tires, fixing brakes, or replacing light bulbs. It's a complex task that needs specialized knowledge and training. Most EV owners find themselves relying on their dealers for service.

#5. Charging Infrastructure

The scarcity of charging stations, particularly in rural and remote areas, is a major challenge the US government has to overcome. It's a game of range anxiety - a constant calculation of miles driven and charge remaining, a race against the battery indicator.

In D.C., the issue of EV infrastructure has taken center stage. The Infrastructure Investment and Jobs Act of 2021, a landmark piece of legislation, has allocated $7.5 billion to develop EV charging stations and related infrastructure. This commitment from the federal government to support the transition to electric mobility is a significant step forward.

#6. Charging Speeds

Charging electric cars can be a problem for drivers as it might force EV owners to adapt their schedules or habits. With just under 80% of public charging stations being Level 2, the amount of time to charge up your EV for the next 3-4 hours of driving can take 4-6 hours or longer. Level 3 chargers are way faster, with some delivering 350 kW power, and can fully charge an EV in 15 minutes. The problem is there aren't many of these due to their set-up cost and extreme power consumption.

#7. Charger Compatibility

There are three different types of DC fast chargers:

SAE Combined Charging System (CCS) used by most manufacturers

CHAdeMO used by Nissan and Mitsubishi

Tesla Supercharger is used solely by Tesla vehicles.

These compatibility differences can hinder widespread EV adoption, as it differs from the universal access to fuel stations enjoyed by gas-powered vehicles.

To overcome this issue, on June 8, 2023, GM announced a partnership with Tesla that will allow GM EVs to use Tesla’s Supercharger network for charging.

Some note-worthy points from the GM-Tesla collaboration:

GM vehicles will be able to use Tesla's Supercharger network starting in early 2024.

GM will also begin installing Tesla's charging connector in its EVs starting in 2025.

The deal is for North America only, but Tesla has said that it is open to expanding the deal to other regions.

#8. Grid Capacity

As more people switch to electric vehicles, the electric grid is poised to face a challenge unlike any before. The transition to electric vehicles isn't merely about swapping gas pumps for charging stations. It's about fundamentally reimagining our relationship with energy. As millions plug in their cars, demand on an already strained grid will increase. However, it's important to note that one of the biggest issues with the grid is meeting "peak demand" times when energy use is at its highest. This issue can largely be managed through the optimization of when people "plug in" their vehicles.

The possibility of having at-home chargers that automatically adapt to times when electricity is in abundance, like during the night, can help mitigate the strain on the grid. Such smart charging methods could help distribute demand more evenly and prevent potential overloads.

The US Department of Energy has predicted a significant surge in electricity consumption by 2050, with a 38% increase primarily attributed to the rise of electric vehicles. It's a future where every personal car, truck, and SUV is a plug-in EV, a future where the hum of electric motors replaces the roar of internal combustion engines.

But what does this mean for our energy infrastructure? The Energy Institute at the University of Texas sought to answer this question by assessing the electrical demand if each state made the switch to electric vehicles. The results were eye-opening. Statewide energy consumption could increase anywhere from 17% in Wyoming to a staggering 55% in Maine. Most states fell within the 20-30% range, a significant increase that could strain existing infrastructure.

Opportunities for Original Equipment Manufacturers

#1. Increasing Demand for Electric Vehicles (EVs)

Driven by mounting environmental concerns, a surge in government incentives, and breakthroughs in battery technology, the global demand for EVs is skyrocketing. In 2022, about 26 million electric vehicles were on the road, up 60% relative to 2021 and more than 5 times the amount in 2018.

In this rapidly evolving landscape, Original Equipment Manufacturers (OEMs) stand at the precipice of a golden opportunity. It’s not just about adapting to change but about shaping the future of mobility. For OEMs, it’s a call to broaden their horizons to venture beyond the familiar territories of conventional vehicles. It’s about envisioning product lines that are not just in tune with the times but one step ahead. They have the opportunity to roll out a selection of electric vehicles that cater to the diverse needs of today’s eco-conscious, tech-savvy consumers.

#2. Government Policies and Incentives

Many governments worldwide promote using EVs to reduce carbon emissions and achieve climate goals. They offer various incentives, such as tax credits, subsidies, and grants for EV manufacturers and buyers. This creates a favorable environment for OEMs to invest in the EV sector. Here are some policies the US Department of Transportation has launched to increase EV manufacturing:

EV infrastructure funding and financing for rural areas

The purchase incentives on electric vehicle purchases

Advanced Technology Vehicles Manufacturing (ATVM) loan program

#3. Advancements in Battery Technology

You can see clearly the leaps and bounds we're seeing in battery tech. They're completely changing the game for electric vehicles. They're getting better, more efficient, and, the best part, more affordable. OEMs are using these advancements in battery technology to push the boundaries of what's possible. They're not just tweaking their designs - they're revolutionizing them. They're making electric vehicles that are sleeker, faster, and more energy-efficient.

Opportunities for Established Suppliers

Charging Infrastructure Development: With the number of EVs increasing rapidly, companies must increase the installation of charging infrastructure with it. One way established companies can do this is to provide home and public charging solutions to make everyone's life easy.

Electric Heavy-Duty Trucks: Established suppliers like Li Auto, NIO, etc., who aren't currently manufacturing heavy-duty should enter the truck manufacturing business as there are just a handful of companies doing so (~20 companies). The heavy-duty truck market surpassed $250 billion in 2022. With just 20 players in a marker this big, there’s a lot of opportunity to thrive.

Micro-Mobility Solutions: Apart from trucks, established suppliers can have a manufacturing line for micro-mobility EVs like bikes and scooters.

Fuel Cell Electric Vehicles (FCEVs): Although currently less common than battery electric vehicles, FCEVs represent another area of opportunity. Suppliers can develop hydrogen storage solutions, fuel cells, and related technologies for these vehicles.

Opportunities for Startups

Battery Technology: As the demand for EVs increases, there is a growing need for more efficient and cost-effective batteries. Currently, EVs on the road are capable of using 77% of the electrical energy from the grid to power the wheels. There’s room for improvement here that startups can focus on.

EV Manufacturing: When it comes to EVs, customers have car models to choose from. Startups can focus on producing unique EV models, targeting specific market segments, or offering innovative features that set them apart from the competition.

Software Solutions: The EV industry requires various software solutions, from battery management systems to navigation and entertainment systems that up-and-coming startups can launch based on AI and ML.

Aftermarket Services: As the number of EVs on the road increases, there will be a growing demand for aftermarket services, including maintenance and repair, battery recycling, and software updates.